Have you been thinking about going back to college? If going to school didn’t work out, you might wonder how to go back to college after dropping out.

Maybe you’ve been frustrated at work, or opportunities for advancement have passed you by.

Starting and finishing a degree is something that most people will think about for years before taking that first step. You probably have a list of reasons why going back to college will be challenging.

But the sooner you start, the faster you can take your career to the next level.

Below are four ways to plan for your journey back to the undergraduate degree that could change your life. Going back to college is possible and a better option than you imagined.

Find the Time to Go Back to College

The biggest hurdle some students face is time. It takes time to earn your degree, and if you have a full-time job and are raising a family, time is at a premium.

There are ways to make things easier on yourself. Here are some ideas:

- Find a program that offers evening and weekend classes.

- Enroll in a program part-time.

- Use student loans to pay for college and reduce your work hours.

Don’t let the time it will take to get your degree dissuade you from doing so. Too many people never begin because they see the four- or five-year commitment, and it seems like they’ll never finish.

But 20 years from now, when you’re at a job you love and making money that wouldn’t have been possible without the degree, those four years will seem worth the time.

You can also consider degrees that take less time. An associate degree can typically be completed in two years, and bachelor’s degrees can be completed in three years of study.

At Nebraska Methodist College (NMC), some programs allow students to earn dual degrees. The respiratory therapy program has an option to earn an associate degree then finish a bachelor's degree 100% online while you're working part- or full-time. The imaging sciences program also has a dual degree option that can be completed in three years.

Read more: Step-by-Step Guide: How to Transfer Colleges

Think Long-Term About Your Investment in College

Thinking about how you’re going to pay for college may seem overwhelming.

The thought of taking out student loans, especially when finances are a struggle, is enough to cause most people to pause their college plans. But when weighing the costs and benefits, it’s best to play the long game.

The income divide between those who earn their high school versus college degrees is striking.

Early in life, high school graduates tend to make more money than their college counterparts. They get a job right out of high school and may get regular annual raises.

Meanwhile, those who go to college have student loans and take longer to get started.

People who started working full-time straight out of high school might be making more money than new college graduates just entering the workforce.

But things begin to change after a few years. Those with a college degree received more opportunities, and their pay reflects these heightened job prospects. More importantly, after ten years or so, student loans tend to be paid off, thereby increasing net gain even further.

That means that, in the long run, people tend to make more money with a college degree, even once student loans are taken into consideration.

Weigh All of Your Financial Options

Scholarships are not just for students who have just graduated from high school. Financial aid options exist for people of all ages in many different programs.

At NMC and many other schools nationwide, upfront merit scholarships are provided to transfer students with certain GPAs. You can also independently pursue scholarship options, some from the school itself and others from outside sources.

You’ll also be able to complete the Free Application for Federal Student Aid (FAFSA). It costs nothing to attain a FAFSA ID and apply for federal aid, but depending on your income level, the level of support you get from the government could make going back to school much easier than you anticipated.

With student loans, you won’t have to spend your income on your college degree. Student loans allow some people to finish school faster than they otherwise would because they can live partially off of financial aid. Some students can stop working completely or work part-time.

No one relishes the idea of taking on more debt through student loans, but the income you might qualify for upon graduation could offset what you pay to put yourself through school.

Read more: Four Ways to Get All the College Scholarships You Can

Create a Support System for Your Education Journey

Although it may seem like the weight of the world is on your shoulders, remember that you don’t have to go this alone.

For some, family or friends provide the incentive and the encouragement needed to complete school. But you might not realize the abundance of resources your college has in place to support your educational goals.

TRIO Student Support Services, for example, provides tutoring, financial assistance and more to first-generation college students who meet a certain low-income threshold and/or have a physical or learning disability.

Even if you don’t qualify for TRIO, you should use the resources offered by your school.

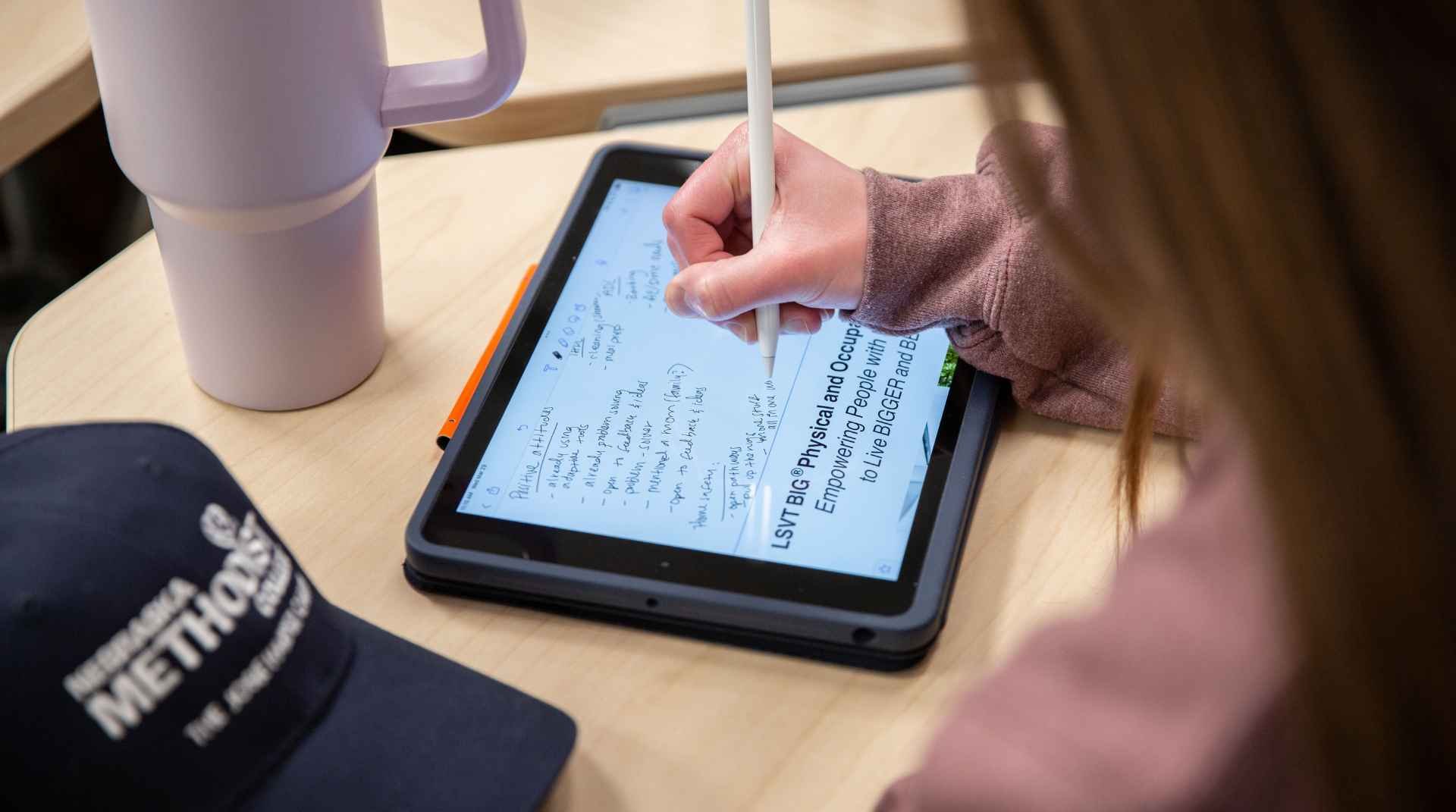

At NMC, our students can take advantage of student support services, including one-on-one counseling with their professors, an online form of assistance called NetTutor, peer-to-peer support and more. Not every school will have those options, but every school should have something in place.

When you’re considering college, make sure they have support systems in place so that you can be successful. Read more: How You Can Receive Mental Health Services at NMC

Take the Next Step to Apply to College

Returning to college can seem rather difficult at times, but those who make the leap find it’s the best decision they’ve ever made.

By looking at the possibilities that exist and approaching them with determination and planning, you can begin the journey to the degree you’ve been putting off.

Ready to get serious about returning to college? Download our 11-Step Guide.

If you’re ready to apply, fill out an online application.